Street Level

Real Estate Investing in Singapore

Archive Contact Colophon Disclaimer

Will Singapore Office Rents Rebound in 2017?

— 28 Apr 2017

CBRE Research reports that the office sector in Singapore is showing signs of bottoming and might possibly be seeing a rebound. However in our view, we expect there will be further deterioration from here before a turnaround will be seen for the sector.…more

Park Place Residences at Paya Lebar - A Review

— 17 Mar 2017

Australian-listed developer, LendLease, will soon be formally launching a new condominimum project, Park Place Residences (“PPR”) in District 14 (“D14”) of the Paya Lebar area. This 429-unit project, is part of the Paya Lebar Quarter, an integrated development project which includes three office towers and a shopping mall. The development is built on a “live-work-play” concept and positioned to be the significant landmark in the Paya Lebar area which is earmarked to be the next commercial hub outside of the Central Business District (“CBD”). PPR, a 99-year leasehold condominium project, will have a mix of one to three bedroom apartments across three residential blocks, with one bedroom units ranging from approximately 500 to 600 square feet (“sqft”) in size, two bedroom units from 650 to 900 sqft, and three bedroom units from 1,050 to 1,350 sqft. Indicative price starts from S$780,000 for 1-bedders, S$1 million for 2-bedders and S$1.6 million for 3-bedders. Temporary Occupation Permit is expected to be obtained by second half of 2020.

Source: Park Place Residences, LendLease…more

Singapore Residential Property- How Will The Easing of Cooling Measures Impact Property Prices?

— 14 Mar 2017

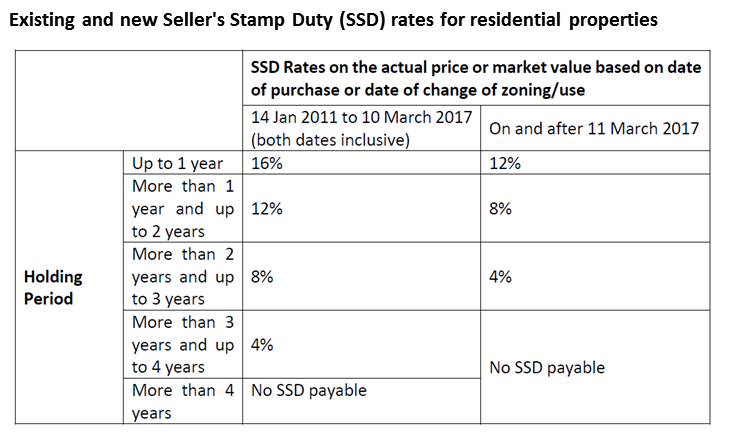

On 10 March 2017, the Singapore Government announced adjustments to the previously enacted residential property cooling measures relating to the Seller’s Stamp Duty (“SSD”) and Total Debt Servicing Ratio (“TDSR”). With effect from 11 March 2017, the SSD will be reduced to 3 years (from 4 years before) and will be lowered by four percentage points for each tier. The table below summarizes the changes to the SSD for the respective holding periods.

Source: Monetary Authority of Singapore

In addition to the SSD changes, the TDSR framework will now no longer apply to mortgage equity withdrawal loans with Loan to Value (“LTV”) ratios of 50% and below. This adjustment on TDSR is taken in response to feedbacks received by the Government that the previous TDSR framework restricts retirees from borrowing against the value of their properties to obtain additional cash.…more

Singapore Tourism - Scorecard for 2016

— 24 Feb 2017

We made our first call on the Singapore hotel sector back in September 2016. In line with our expectation, the Singapore tourism sector had a record year, hitting 16.4 million visitors in 2016, a 7.6% growth from 2015.…more

Rising Interest Rates - Which REIT will be the most affected?

— 20 Jan 2017

The US Federal Reserve finally hike interest rates for the second time in a decade on 14 December 2016. Singapore interest rates correspondingly rose alongside the hike with the 3-month SIBOR and SOR continually testing the 1% level in the last few weeks. There is now stronger expectation that the Feds will be more aggressive in raising rates this year, with three rate hikes anticipated for 2017. As interest cost is the biggest variable on profitability for real estate investors, we should carefully consider the risk and impact of these trends. In this article, we share our views on the impact of rising rates on Singapore REITs (“S-REITs”). Most S-REITs have well-managed debt profiles and are not overly leveraged (lesson gleaned from the the global financial crisis) so the current rising interest rate is unlikely to be a significant downside risk immediately to the S-REIT sector.…more

Quick Review of 2016 for the Singapore Real Estate market

— 03 Jan 2017

Copyright 2015 Global Art Ltd

2016 has been a year of mostly negative surprises, despite starting the year on a relatively upbeat mood, bolstered by the positive vibes from the General Election results concluded in September 2015. We look forward (with trepidation) to what President-Elect Trump will unveil post his Jan 20 inauguration, how Theresa May will handle the Brexit process as well as further developments in the South China Sea, all of which to some extent, will have an impact on this tiny sunny island of ours. To close off 2016, we highlighted some of the key developments this year which had affected the Singapore Real Estate Market below.…more

Singapore REITs - Which sector will outperform in 2017?

— 09 Dec 2016

Singapore REITs (“S-REITs”) offers high and stable dividend yields from exposure to the real estate sector (primarily in Singapore and Asia Pacific). It is the highest yielding REIT market among developed countries, yielding over 6% per annum on average. But not all S-REIT sectors are the same and careful selection of your exposure to the right sector can help you outperform the general S-REIT market. In this article, we provide a summary of our views on the key real estate fundamentals (i.e. rental growth, supply pipeline, potential threats, and valuation) across the various S-REIT sectors that has a primary exposure to Singapore real estate.…more

Singapore REITs - Is it time to invest?

— 25 Nov 2016

Most blue-chip Singapore REITs(S-REITs) prices have declined 4% to 6% on average since the results of the US Presidential Elections. S-REITs now trade at an average of 6.8% yield and 0.95x Price to NAV (P/NAV) as of 24 November 2016. With the weakness in S-REIT prices in the last 2 weeks, is now a good time to invest into the sector?…more

Singapore Residential Property Prices - How Much Lower?

— 05 Nov 2016

Picture By Erwin Soo

In 3Q 2016, Singapore’s private residential property prices continue to slide by 1.5%, taking the total drop in property prices to 11% from its peak in 2013. Market watchers and potential investors continue to wait for the elusive bottom in this property cycle. We believe that there is room for further decline in property prices and we share the key reasons behind our view.…more

The Search For Yield

— 28 Oct 2016

Prolonged record-low interest rate cycle has driven investors to high yield stocks, REITs and property in the last few years. Even now, bond yields and interest rates seems likely to remain at low levels for longer than expected given the shaky state of the global economy. We believe that REITs are well placed to benefit from this economic environment and will continue to outperform other asset classes in the medium term…more

Understanding REIT Valuation - Implied Property Yield

— 14 Oct 2016

Two common valuation metrics used by investors when assessing REIT investments are Premium (Discount) to Net Asset Value (“NAV”) and Distribution Yield. The former implies a relative value of the REIT while the latter provides an estimate on the cash flow returns for holding the REIT. While these are useful shorthand for understanding value, we caution that simply relying only on both of these metrics will not fully reflect the true underlying value and cash flow of the investment properties held by the REIT.…more

Which Hotel REIT to Invest In

— 30 Sep 2016

Good investors will always do thorough research before deploying any capital. Risk management is of utmost importance when it comes to investing, and one of the most important way to manage risk is to know your investments well. In our previous post, we highlighted that hotel REITs is one of the sub-sector to watch out for. However, not all hotel REITs are the same and it is important to know exactly what you are buying into.…more

Hotel REITs - The Bright Spot in the Real Estate Sector

— 02 Sep 2016

With uncertainties around the global economic climate and Singapore’s economic growth, it is a challenge for real estate investors to seek out profitable investment strategies at the moment. We have strong reasons to believe that hotel REITs is a sub-sector to watch out for and could outperform other REIT sectors in the mid-term. In this post, we share our thoughts on the key demand drivers for the travel industry and how hotel REITs will benefit from the trend.…more

Singapore Real Estate - What Drives Long Term Value

— 26 Aug 2016

Picture from Gov.Sg | PSA Singapore Terminals

Latest estimates from the Ministry of Trade and Industry indicates that Singapore’s economy is forecast to grow by 1-2% in 2016. Against the backdrop of continued slow growth and the gloomy economic climate, we think it is timely to take a step back to evaluate where Singapore is currently, what the economy would look like in the next 20 years and consider what will drive Singapore real estate value in the long run.…more

Why REITs might be a better investment than residential property

— 05 Aug 2016

Singaporeans usually prefers to invest in private residential properties as compared to Real Estate Investment Trust (REITs). We believe this is largely due to- Emotional security from holding a tangible asset

- Potential for sizable capital gains

- Familarity with the asset class & revenue model (everyone stays in one & renting out a property is simple to understand)

…more

Myths about Property Investment

— 28 Jul 2016

Designed by Freepik.com

Investing in real estate is a popular way amongst Singaporeans to grow their wealth. In this post, we discuss how real estate investors can invest smartly and avoid some of the common misconceptions.…more

Catching the Wind ― When to Invest in Singapore Residentials Again

— 15 Jul 2016

The Interlace | CapitaLand

Many real estate experts now concur on the view that a reversal in the Singapore property cooling measures would not take place in the near future. Instead of trying to pinpoint a date for that to happen, we feel it is more relevant for potential investors to assess under what conditions the cooling measures be eased and how it will likely be done when it happens.…more

Investing in high quality REITs in an unpredictable market

— 08 Jul 2016

We had previously discussed taking a long term view on post-Brexit volatility and focusing on investing in quality companies instead. Since Brexit, strong sponsor-backed REITs have outperformed their peers in what we described as a two speed market. CapitaLand Commercial Trust, Ascendas REIT and Mapletree Industrial Trust have seen their share price increase by 10%, 7% and 12% respectively, while Sabana REIT has dropped 5%, and Viva Industrial Trust and Cambridge Industrial Trust has seen only relatively mild increases of 1% and 2% respectively.…more

Short-term pain, long term opportunities

— 01 Jul 2016 The extreme volatility in global markets post-Brexit is a knee-jerk reaction to the uncertainty and lack of confidence in the world’s economy, particularly Europe. The bigger implication, however, is the risk of a Brexit contagion to Europe, with negotiation on the Brexit terms expecting to take years at least. While many investors are understandably feeling uncertain during this period, we should stay focused on the longer term opportunities that arise despite the political chaos.…more

Hello, World! And Brexit!

— 24 Jun 2016 If you are launching a financial blog, what better day to do it than on Brexit day? The UK has just voted for a smaller and less inclusive society. As our own Prime Minister had put it, only time will tell if the UK has made the right decision. We see similar echoes of this in our very own little red dot, with the largest public protest ever organized in Singapore’s history over the 2013 Population White Paper. Hong Kong’s Umbrella Movement, Arab Spring, the rise of Trump, etc. – the people are voting unconventionally because of perceived inequalities and a slow realization that perhaps our generation will not be better off than our parents’.…more