The Interlace | CapitaLand

Many real estate experts now concur on the view that a reversal in the Singapore property cooling measures would not take place in the near future. Instead of trying to pinpoint a date for that to happen, we feel it is more relevant for potential investors to assess under what conditions the cooling measures be eased and how it will likely be done when it happens.

What is the Government trying to achieve?

Some market watchers believe that the recent easing of car loan financing is a pre-cursor to the removal of cooling measures implemented over 2010-2013. We do not subscribe to this view because we believe that the ultimate intent of the Government for the direction of car prices and property prices is fundamentally different.

The Government has announced its blue-print for Singapore to become a car-lite country. For this to happen, one key policy will be to discourage car ownership, which is done by keeping the prices of cars and cost of usage high. We see evidence of this through the recent rise in public car park rates and the lower COE quota underpinned by the announced low annual vehicle growth rate of 0.25% per annun. We believe the easing of loan-to-value (“LTV”) on car loans is meant to play a part in this policy measure.

On properties, we believe the Government’s primary objective is to provide for a stable and sustainable property market to encourage primary home ownership (not speculative investments) and also allow for gradual long term capital appreciation. The property cooling measures was meant to discourage fluid foreign capital inflows and excessive leveraging. For this reason we do not think that the easing of cooling measures is linked to the policy changes around car financing.

So under what conditions will the Government consider easing the cooling measures?

We believe that the following key factors will be crucial in the Government’s consideration to reverse the Singapore property cooling measures.

1. Rising interest rates

Low interest rates encourage property speculation through cheap money. Given Brexit and the lack of direction of the global economy, we expect US interest rates and correspondingly the Singapore interest rates to remain low for the remainder of 2016, full year 2017 and arguably even early 2018. We believe the Government will wait for a rise in interest rates (and the subsquently fall in asset prices) before they will consider a relaxation of the cooling measures.

2. Significant correction in residential property prices

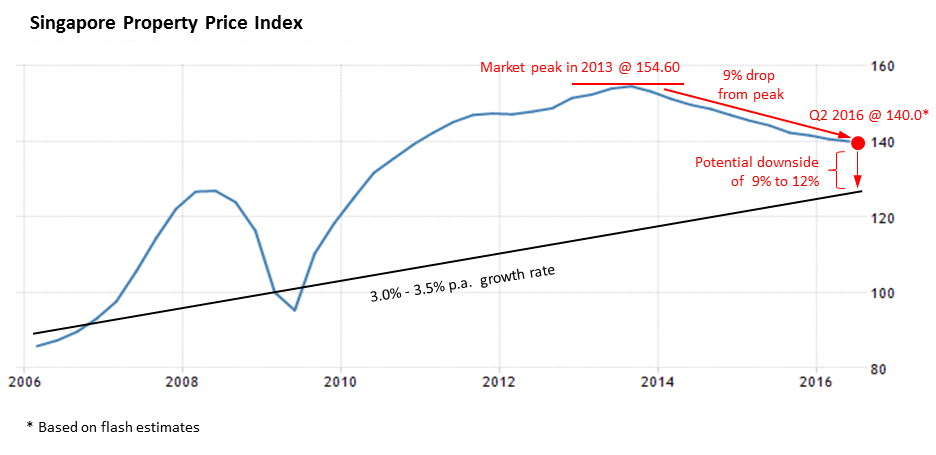

How much would residential property prices need to adjust for the Government to remove the cooling measures? If we assumed a 3% to 3.5% natural growth trajectory for property prices (per diagram below), private residential property prices has only corrected 9% since its peak in 2013. As such, we believe that there is still c.9% to 12% downside for property prices before the easing of the cooling measures might take place. Projecting this forward, we believe the easing is not likely to happen until at least 2018.

Source: www.tradingeconomics.com | Urban Redevelopment Authority

3. Completion of majority of the supply pipeline

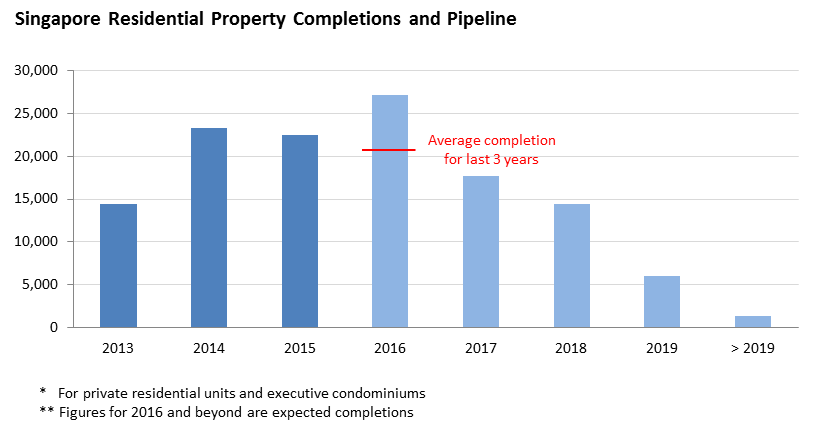

Supply of private residential units and executive condominiums (“EC”) is set to peak in 2016 with expected completion at over 27,000 units. However, we note that there is still substantial completion pipeline coming online in 2017 and 2018, which is 88% and 72% of the average supply for last 3 years. We believe that the Government would wait for the bulk of this supply to hit the market (which corresponds to more moderate property prices) and assess the impact before considering any easing of the cooling measures. In addition, the market has seen an increase in buyers snapping up residential real estate (both resale and new properties) in the last few months. While these transactions are mainly done at lower prices, the increase in volume shows that many investors are sitting on the sideline waiting to enter the property market when the prices are “right”.

A soft landing is what we believe the Government wants to achieve and a premature easing would likely cause a blip and then a drop in property prices ― not an ideal scenario.

Source: Urban Redevelopment Authority

For reasons outlined above, we hold the view that that the easing of property cooling measures will only likely take place in 2018 at the earliest (after the above benchmarks are met). Select opportunities remain but given the potential for further downside, as with all things, caveat emptor.

How will it be done when it happens?

We expect the easing of the property cooling meassures to take place via controlled phases, consistent with our view of a soft landing. The easing is likely to start with a gradual step down of the Additional Buyers Stamp Duty (“ABSD”) and moderate increase in the allowable LTV ratio.

However, we believe that the caps on Total Debt Servicing Ratio (“TSDR”) and the Mortgage Service Ratio (“MSR”) are here to stay, as those policies are meant to prevent excessive leveraging and systematic risk from building up in Singapore.