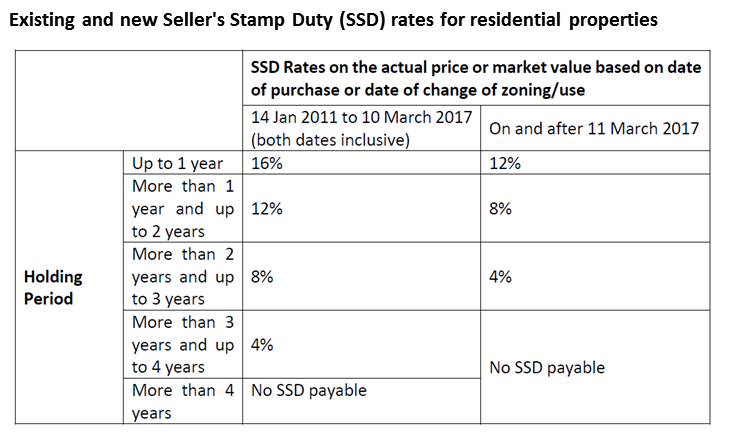

On 10 March 2017, the Singapore Government announced adjustments to the previously enacted residential property cooling measures relating to the Seller’s Stamp Duty (“SSD”) and Total Debt Servicing Ratio (“TDSR”). With effect from 11 March 2017, the SSD will be reduced to 3 years (from 4 years before) and will be lowered by four percentage points for each tier. The table below summarizes the changes to the SSD for the respective holding periods.

Source: Monetary Authority of Singapore

In addition to the SSD changes, the TDSR framework will now no longer apply to mortgage equity withdrawal loans with Loan to Value (“LTV”) ratios of 50% and below. This adjustment on TDSR is taken in response to feedbacks received by the Government that the previous TDSR framework restricts retirees from borrowing against the value of their properties to obtain additional cash.

What impact does these changes have on residential property prices?

We think that there will be little or no impact to the trajectory of residential property prices as the adjustments are narrowly targeted and aimed at moderating near term demand and supply. We believe the key objective of the Singapore Government is to maintain the “soft landing” that Singapore real estate prices have been experiencing. Amid clear signs that rates are rising, which will have a negative impact on demand with regards to Singapore properties, we believe the Singapore Government is proactively tweaking the supply side of the equation (by relaxing it slightly) in order to maintain the current equilibrium in the market. There might (counterintuitively) be some spikes in near term prices as buyers who are waiting in the sidelines jumped into the market now after the Government’s announcement but the overall price trajectory for 2017 should not be drastically different. We also note that the new SSD rates will only apply to residential property purchased on and after 11 March 2017. This implies that the secondary market will only see an increase in supply 3 years down the road, after most of the current supply would likely had been absorbed by the market.

We are, therefore, of the view that this adjustment in SSD is purely meant to keep the residential property market stable by moderating near to mid-term demand-supply dynamics.

The change to the TDSR framework is also minor and will have limited impact to property prices as it is again narrowly targeted at retirees looking to borrow against their property to fund retirement needs. Most local homeowners and investors are likely to leverage beyond 50% for their residential property investments and hence this is unlikely to materially lift demand for residential property investments.

Where will property prices go from here?

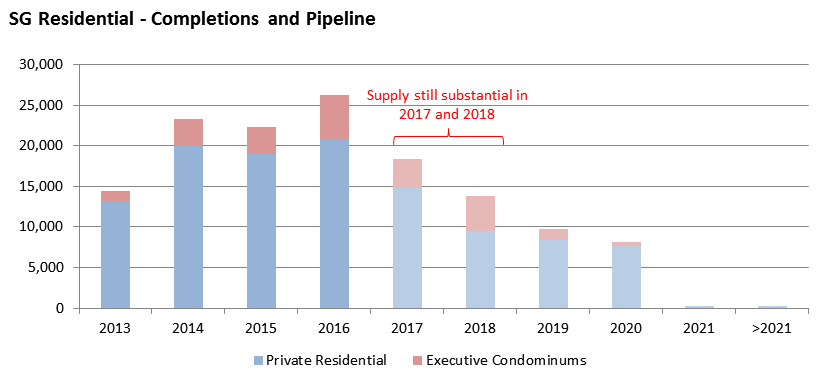

We maintain our view that property prices will continue to fall further for the remaining of 2017 and possibly first half of 2018, as the supply in the next 2 years is still substantial, albeit being lower than the last 3 years.

Source: Singstats

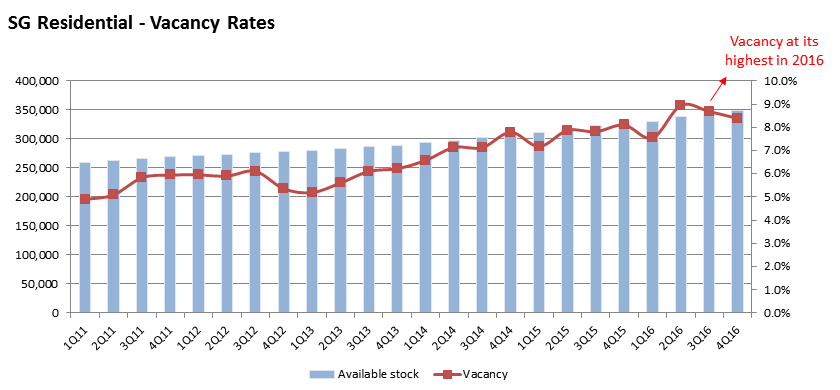

Current vacancies of vailable residential properties is still high at approximately 8% to 9%, implying that residential rents still have further room to fall which will in turn impact property values.

Source: Singstats

Demand for residential properties in the secondary market will likely be weak until we see positive changes to the Additional Buyer Stamp Duty (“ABSD”), immigration stance (anecdotal reports continues to be negative with some saying there is an unofficial position of 7 foreign leavers for every 1 new foreign entry) and / or an improvement in the confidence of the global economy. Furthermore, the potential interest rate hikes will most certainly impact capital values when the effect of it flows through to investors, although the latter will probably have a time lag of 2-3 quarters for asset owners to really feel the pinch and enter the seller’s market.

We will love to hear your thoughts on the residential property market too. Feel free to leave us a comment in the box below.