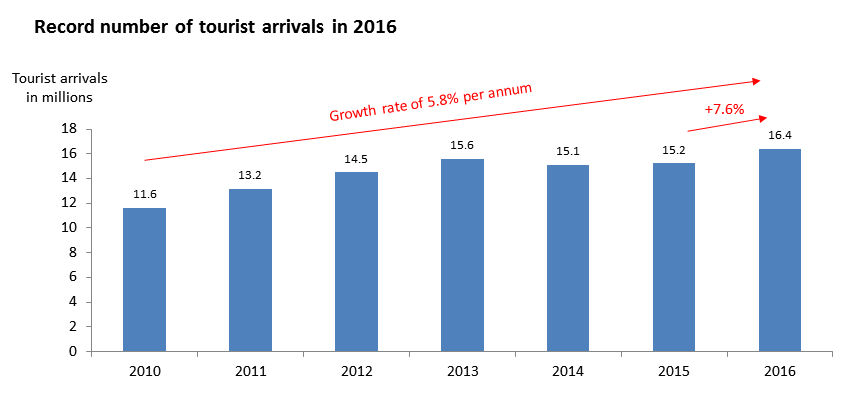

We made our first call on the Singapore hotel sector back in September 2016. In line with our expectation, the Singapore tourism sector had a record year, hitting 16.4 million visitors in 2016, a 7.6% growth from 2015.

The strong growth is driven by the intense marketing efforts of the Singapore Tourism Board, promoting the city-state as a destination for both leisure and business. This has resulted in increased visitor arrivals from the top source markets of China, Indonesia, and India, notwithstanding that other ASEAN markets like Vietnam and Thailand also delivered double digit growth.

Source: Singstats

Growth momentum in arrivals should continue

We believe that this growth momentum will carry into 2017, supported by a slew OF tourism events over the year such as the F1, WTA Championships, Singapore Ruby Sevens Series, ICRA 2017, Interpol World 2017, IFMC 2017, and etc. Tourism have been a key pillar of the Singapore’s economy and the government have been actively supporting the industry through project funding and infrastructure development. The momentary threat of the Zika virus have faded away and have not been a significant dampener to the local tourism scene as we expected.

Rejuvenation of tourism attractions will keep Singapore competitive as a tourist destination

The makeover of the Mandai Zoo, the reopening of the Bukit Timah Nature Reserves, the redevelopment of six Sentosa precints are just some examples of how Singapore continues to innovate to keep the tourism industry sustainable and refreshed. Further, the Singapore Tourism Development Fund continues to assist the industry in developing new tourism products and improving productivity through technology.

Constructon of key transport infrastructure will support the longer term growth of the tourism industry

Changi Airport Terminal 4(T4) is now completed. T4 will support the increasing number of arrivals into Singapore starting from second half of 2017. In the longer term, the Changi Airport Terminal 5(T5) and the High Speed Rail(HSR) between Singapore and Kuala Lumpur will come online. T5 is expected to be the world’s third largest airport and will be operational by 2020. The HSR will also a significant booster to Singapore tourism as it cements Singapore as the regional hub of Asia Pacific travel with the added connectivity to Kuala Lumpur and its strategic positioning between North Asia, ASEAN and the Pacific.

Tourism spending has been robust and growing, but a large influx of hotel room supply in the last 2 years have absorbed the demand for accomodation thus far…

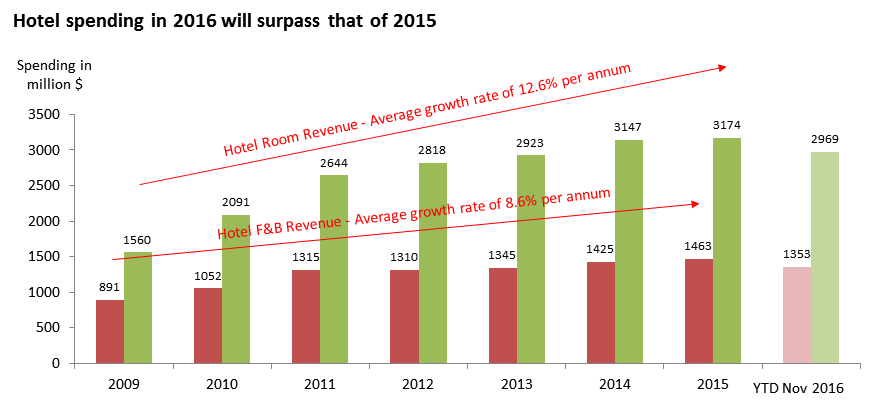

The increase in tourism arrivals has correspondingly driven the increase in tourism spending for the past few years. Hotel room revenues grew 12.6% per annum over the last 7 years while hotel F&B revenue grew 8.6% per annum over the same period. Full year 2016 numbers is also expected to surpass that of 2015. The strong growth has yet to translate into higher hotel occupancy rates and room rates yet, due an large supply of hotel rooms in 2016 and 2017.

Source: Singstats

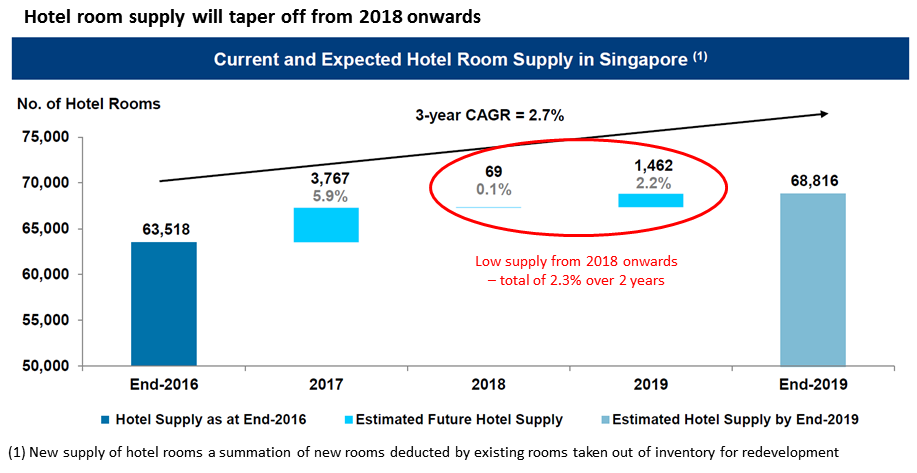

… however the supply of hotel rooms will taper off from 2018 onwards

Supply of new hotel rooms will taper off significantly from 2018 and we believe this would reverse the trend in occupancy and room rate growth for the hotel industry within the next 12 to 18 months, assuming travel demand continues to be sustained.

Source: Singstats

Conclusion

Demand drivers for Singapore tourism remains robust and strong, well-supported in the long term by tourism infrastructure. Outlook for the industry remains positive and tourism will continue to be a key pillar to the Singapore economy. In the short-term, we expect room rates and occupancy to bottom out in 2017, but the trend should reverse moving into 2018 due to the relatively low supply thereafter. Retail investors who wish to gain exposure to the sector can consider investing in listed hospitality S-REITs that has Singapore hotels.