The US Federal Reserve finally hike interest rates for the second time in a decade on 14 December 2016. Singapore interest rates correspondingly rose alongside the hike with the 3-month SIBOR and SOR continually testing the 1% level in the last few weeks. There is now stronger expectation that the Feds will be more aggressive in raising rates this year, with three rate hikes anticipated for 2017. As interest cost is the biggest variable on profitability for real estate investors, we should carefully consider the risk and impact of these trends.

In this article, we share our views on the impact of rising rates on Singapore REITs (“S-REITs”). Most S-REITs have well-managed debt profiles and are not overly leveraged (lesson gleaned from the the global financial crisis) so the current rising interest rate is unlikely to be a significant downside risk immediately to the S-REIT sector.

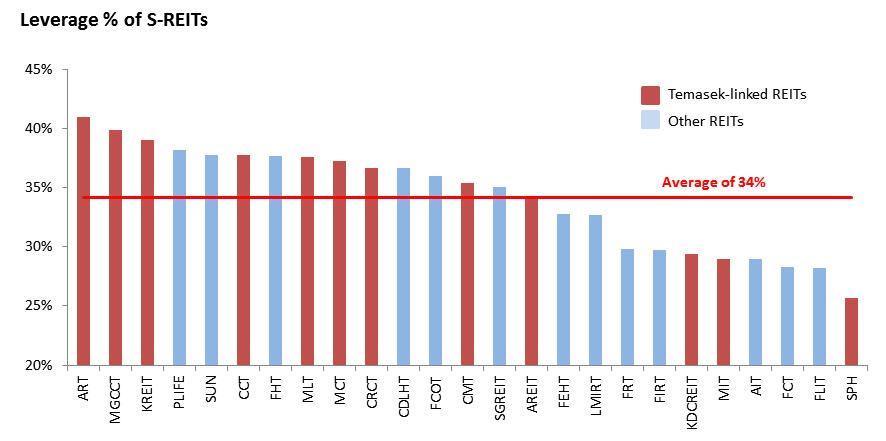

S-REITs with high levereage are typically more sensitive to rising rates

Obviously the higher a S-REITs is levered, the more sensitive it is to interest costs. S-REITs on average are geared at c.35% debt-to-assets. According to Singapore’s regulatory framework on REITs, there is a 45% cap on the maximum leverage an S-REIT can take on - currently, the REIT with the highest leverage is Ascott Residence Trust (“ART”) at c.41% leverage, which is still within the regulatory cap. In our view, Temasek-linked REITs (of which ART is one) tend to have stronger financial flexibility and influence when it comes to bank borrowings or accessing the debt capital markets. Hence it is not surprising that all three of the highest levered REITs are Temasek-linked.

Source: Company Filings

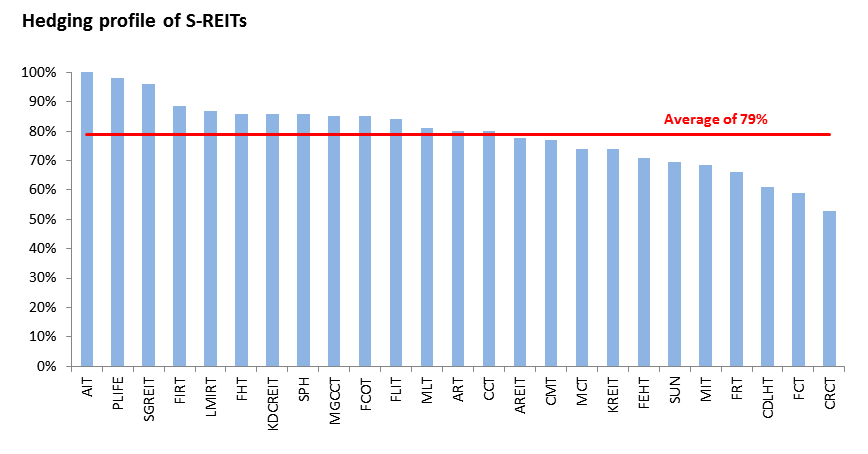

Interest rate swaps and fixed rate borrowings lowers interest rate risk

Most S-REITs hedged a substantial portion of their bank borrowings through interest rates swaps or options. S-REITs can also tap the bond market for fixed-rate medium term debt. Most bond issuance in Singapore are fixed rates and therefore REITs with the ability to tap the bond market have the advantage to lock-in interest costs for the medium term. In addition, S-REITs on average hedged c.80% of their borrowings. Among the 25 REITs analyzed1, 14 has more than 80% of their borrowings hedged, although most hedges are for the short to mid-term (due to the high cost of hedging beyond that period). Hence eventually, in the long run, higher interest rates will negatively impact the REITs. However, for the purpose of our analysis, we will only assess the risk of rising rates in the next 12 months as we believe that rising interest rate over a multi-year period should be driven by better economic fundamentals which in turn accelerate revenue growth (via higher rentals) of the REIT and thereby minimizing, if not improving, a REIT’s distribution.

Source: Company Filings

Office and Retail REITs are more exposed in a rising rate environment

Office and retail REITs tend to have lower yields as compared with industrial & logistic REITs. A typical Grade-A office building or a retail mall in Singapore yields about 3-5% while an industrial & logistic property yields about 7-9% (return on capital vs. return of capital distinction aside). Therefore, financing expenses as a proportion to revenue are higher for office and retail assets, resulting in greater sensitivity to changes in interest rates.

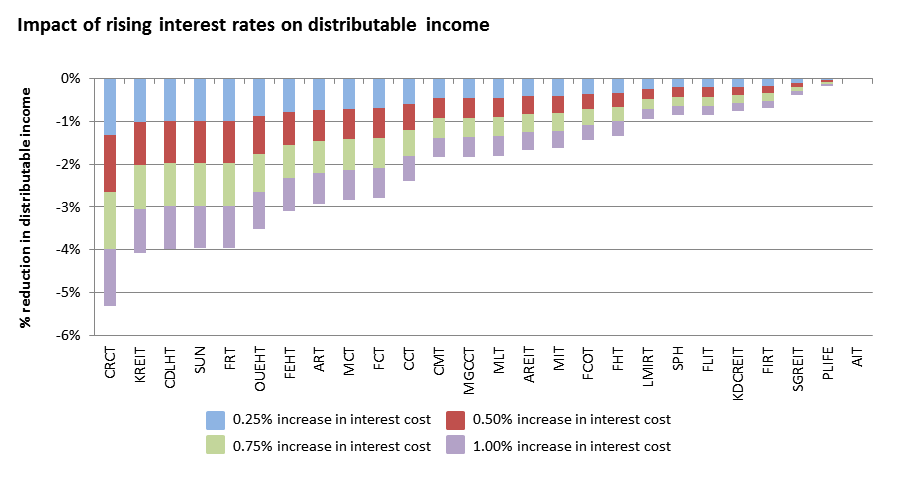

Potential impact of rising rates on S-REITs

Taking the above into considerations, the diagram below provides the output of our analysis.

Source: Company Filings, Street Level

The top 3 REIT most sensitive to higher interest rates are CapitaLand Retail China Trust (“CRCT”), Keppel REIT (“KREIT”) and CDL Hospitality Trusts (“CDLHT”). These REITs are characterized by a lower proportion of hedging on their debt at 53%, 74% and 61% respectively and above average leverage (relatively speaking as we note that substantial headroom remains before reaching the regulatory cap). Taking these factors into consideration, it seems that the short-term impact of higher rates on distributable income of the REITs would not substantial. On average, we expect to see a reduction in distributable income of only 2.1% and 1.1% for a 1% and 0.5% rise in rates respectively, due to a large proportion of borrowings that is already hedged and the generally low leverage of Singapore REITs.

Conclusion - Rising rates should not pose a significant risk to S-REITs in 2017

We believe that rising rates pose no immediate threat to S-REITs. We also have the view that S-REITs more sensitive to a rising interest rate are not necessarily the REITs to avoid as there are other factors to consider in assessing the potential viability of a REIT investment. While it is market consensus for interest rates to rise in 2017, it is also our view that any increase will be modest due to the general macroeconomic slowdown. Coupled with the generally conservative capital structure of most S-REITs, we think that REIT distributions should not be materially impacted by rising interest rates in the short-term. We had also previously discussed our reasons for a structurally lower interest rate environment in the next decade.

We hope you find this article useful. As usual, please leave any questions or comments in text box below.

-

Our analysis focused on the largest 25 REITs by market capitalization listed on SGX. We considered the impact of a 0.25%, 0.50%, 0.75% and 1.00% increase in interest costs on the REITs’ distributable income. The sensitivity is performed only on the unhedged portion of the REIT’s borrowings. ↩