Good investors will always do thorough research before deploying any capital. Risk management is of utmost importance when it comes to investing, and one of the most important way to manage risk is to know your investments well. In our previous post, we highlighted that hotel REITs is one of the sub-sector to watch out for. However, not all hotel REITs are the same and it is important to know exactly what you are buying into.

Know what you are buying - Hotels or service residences?

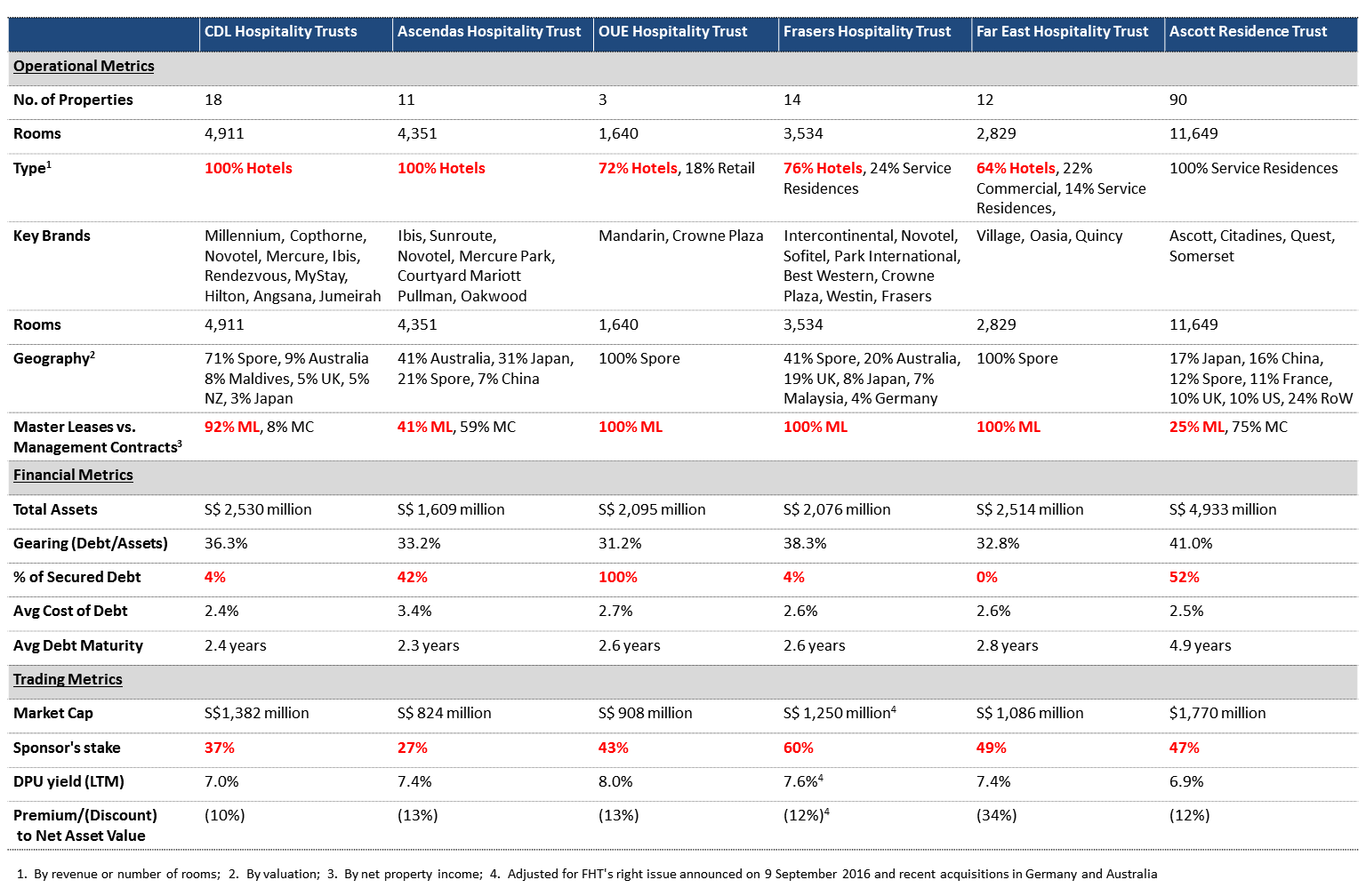

There are 6 hospitality REITs listed on the Singapore stock exchange. Not all of them are pure-play hotel REITs and it is important to look at what assets each of these REIT holds before you invest. Out of the 6 hospitality REITs, only CDL Hospitality Trusts (CDL-HT) and Ascendas Hospitality Trust (AHT) are pure-play hotel REITs; OUE Hospitality Trust (OUE-HT) has a sizeable income derived from the prime-retail segment with its exposure to Orchard Mandarin Gallery; Frasers Hospitality Trust (FHT) and Far East Hospitality Trust (FEHT) have exposure to service residences; Ascott Residence Trust (ART) is actually a pure-play service residence REIT and should not be classify as a hotel REIT as the demand drivers and risk for hotels and service residences are different. For example,

1. Length of stay Hotel stays are usually short from a day to a few days. Service residences cater for longer stays which can last from a week to 12 months. Most service apartments have a minimum number of nights per stay.

2. Size of units Hotel units are usually smaller as compared to service residences. This means that service residences has a lower income yield per area which makes it less space efficient.

3. Amenities and services Hotels have a broader range of amenities (such as meeting rooms, banquet halls, restaurants, spas, etc) and services (such as room service, bell hops, valet, daily housekeeping, etc). These amenities and services can generate a sizable portion of revenues, albeit this also means higher operating costs (risk).

4. Threat of alternative accomdation platform Demand for service residences are more prone to competition from alternative accomodation platforms (eg. Airbnb). As alluded to in our previous post, these alternative accommodation providers tend to target travellers who prefers a “home-like” experience, travellers on medium-term stays, or family/multi-family travel groups which is a direct competition to service residences.

The above mentioned factors significantly differentiates the risk/reward profile of hotel REITs as compared to service residence REITs. Hence it is important to know what property a REIT holds to be able to assess the risk of your investment.

Know the difference between master leases and management contracts

In a master lease, the hotel operator (eg. Starwoods, Accor, etc) leases the hotel from the REIT and pays the REIT a rent. The rent could be a fixed rent, a variable rent (% of revenue and/or % of profit), or a combnation of both. In a master lease, the hotel operator is responsible for all profits and losses after paying the rent to the REIT.

In a management contract, the REIT pays the hotel operator a management fee (usually % of profits) in return for managing the hotel. This means that the REIT is responsible for all profits and losses after paying the management fee to the operator.

The key difference in the two arrangements is where the risk (and also reward) lies. Master leases provides a more stable revenue and defensive income stream to the REIT, whereas hotels on management contracts has more volatile revenue stream but is compensated by larger revenue upside since the REIT takes all profits after deducting the fees to operator.

Knowing which arrangement the majority of the REIT revenue stream comes from can help an investor assess the risk he/she is bearing.

Asset encumberance could have an impact on the ability of the REIT to borrow or refinance

Since a REIT distributes most of its cashflow, the REIT needs 3rd party capital (debt or equity) to grow its income. Hence, the ability of the REIT to borrow money at a cheap rate to acquire assets is crucial to the growth of a REIT. All secured debt are backed by the mortgage of the REIT’s assets. When credit markets are tight, having a higher proportion of secured debt could impact the ability of the REIT to borrow money and/or increase (future) financing costs.

Alignment of interest with a strong sponsor is crucial

The sponsor of a REIT is usually the majority shareholder of the REIT eg. City Developments for CDL-HT, OUE Limited for OUE-HT, and Ascendas for AHT. A REIT with a large sponsor stake implies strong alignment of interest between the sponsor and investors. As mentioned in the previous point, a REIT will need 3rd party capital to grow, so having a strong sponsor can help support the REIT with new equity (through a rights issue or preferential offer) for acquisitions. E.g. Investors usually want the sponsor to have sufficient “skin in the game” and “in it together with the investors” when a dilutive rights issues or preferential offer is called.

So, which REIT do we prefer?

Out the 6 hospitality REITs, we prefer CDL-HT and FHT for the (1) the diversity in their portfolio, (2) majority master-leased properties, (3) strong balance sheet profile and sponsor alignment, and (4) inexpensive valuations.

CDL-HT’s portfolio has a good mix of hotels, from 3-star to luxury hotels with well-known brands. Its assets are located in key tourist markets in the Asia Pacific which we expect continued tourism growth. While CDL-HT’s portfolio is now largely Singapore-focused, we expect the proportion of Singapore hotels to be reduced going forwward given that CDL-HT has been focusing on overseas acquisitions. This will provide further geographical diversification to its portfolio. Most of its hotels are on the master lease arrangement, providing stability to its distributions, particularly in benign market environments. Low asset encumberance and low cost of debt are also strong positives for CDL-HT.

FHT’s assets are across key tourism markets and hubs in Asia and Europe, and has a mix of hotels and service residences. The Fraser’s brand is reputableand the hospitality business is one of the core pillars for its sponsor, Frasers Centerpoint Limited. Recently announced acquisitions in Germany and Australia together with the recent rights issue will grow the REIT’s revenue and strengthened its balance sheet significantly. Post completion of the rights issue, gearing should drop to approximately 34% and will provide the debt headroom for further acquisitions. FHT will be the third largest hospitality REIT by market cap after ART and CDL-HT.

Based on the closing prices as of 30 September 2016, CDL-HT is trading at 7.0% Last Twelve Months (LTM) yield and 10% discount to Net Asset Value (NAV), and FHT at 7.6% LTM yield and 12% discount to NAV.

Below is a summary of the operating, financial and trading metrics of the 6 hospitality REITs listed in Singapore.

Source: Company filings, SGX. Based on closing prices as of 30 Sep 2016