Two common valuation metrics used by investors when assessing REIT investments are Premium (Discount) to Net Asset Value (“NAV”) and Distribution Yield. The former implies a relative value of the REIT while the latter provides an estimate on the cash flow returns for holding the REIT. While these are useful shorthand for understanding value, we caution that simply relying only on both of these metrics will not fully reflect the true underlying value and cash flow of the investment properties held by the REIT.

Premium (Discount) to NAV can be distorted by the valuation of the assets

Bulk of a REIT’s NAV is determined by the valuation of its investment properties. However, professional valuers will be the first to admit that real estate valuations is more art than science. Valuations can be subjective and is based on available comparable data and (to a lesser degree) the opinion of the appraiser.

Case in point, let us compare the valuation of Orchard Hotel (owned by CDL Hospitality Trusts) and Orchard Parade Hotel (owned by Far East Hospitality Trust). Both are hotels in the same price range, located opposite each other along the same road and generally much alike, as demonstrated by the similar room prices. However, Orchard Hotel is valued at SGD 684k per room, while Orchard Parade Hotel is valued at SGD 1067k per room. Orchard Parade Hotel arguably commands a better frontage but it still remains doubtful to us that this will account for a 56% premium relative to Orchard Hotel, ceteris paribus. As such, based solely only on the Premium (Discount) to NAV, it will be premature to conclude if a particular REIT is overvalued or undervalued.

Distribution yield can be financially engineered (and it often is…)

Merely looking only at the cash distributions of a REIT does not account for the fact that it is highly dependent on the composition and sources of funding for its acquisitions. A REIT can increase its distributions by simply funding its investment with more debt (thereby increasing the investment risk). Distributions can also be increased by paying the management fees in REIT units instead of cash (which requires the issuance of new REIT units, hence diluting investors in the long run).

Implied property yield provides a more objective approach to valuation

We propose using an implied property yield to assess REIT investments as an additional tool in the savvy investor’s toolkit. This is a commonly used by real estate investment professionals / bankers to more comprehensively capture the characteristics of the REIT.

What is property yield? Property yield is the rate of return of an investment property. It is calculated by taking the annual net operating income of the property divided by the property value. The yield shows how much cash an investment property can generate for the investor annually after paying expenses.

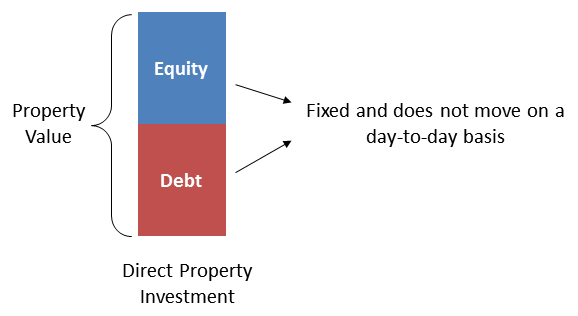

For a direct property investment, the property value is (funded through) a combination of debt and equity.

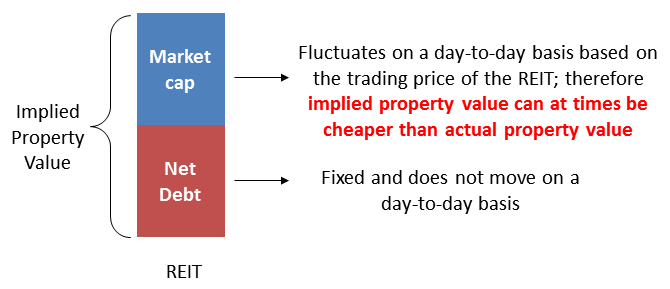

However, for a REIT, the equity value (market capitalization) fluctuates on a day-to-day basis. Hence an implied property value can be derived by taking the market capitalization value and adding the net debt (total debt minus cash) of the REIT. Accordingly, investors can calculate the implied property yield by taking the annual net operating income of the property divided by the resultant implied property value

Simple example - Frasers Commercial Trust’s (“FCOT”) implied property yield

Based on FCOT’s unit price of SGD 1.39, the implied property yield is calculated as:

Net Property Income for the last 12 months / (Market cap + Debt - Cash)

= SGD 113.7 million / (SGD 1,099 million + SGD 737 million - SGD 63 million)

= SGD 113.7 million / SGD 1,773.5 million

= 6.4%

This implies that FCOT’s assets yields an average of 6.4% return based on the current trading price of the REIT. The lower the price of a REIT (lower market cap), the higher the implied property yields (which gives better returns).

Implied property yield as a valuation metric provides a cleaner assessment of the rate of return on a REIT’s properties and can be use as a like-for-like comparison with other physical assets or assets belonging to other REITs to determine how efficient the REIT’s properties are in generating returns for its investors

Limitation of using implied property yield as a valuation metric

As with any valuation ratios, there are limitations in using implied property yield as well. The metric does not take into account the amount of debt (risk) and the financing costs (cash leakage) of a REIT. Therefore, investors need to continue to do their homework, a [key point we had emphasized before]https://street-level.github.io/2016/09/30/which-hotel-reit-to-invest-in.html), especially on the underlying properties and use implied property yield in conjunction with other financial and non-financial metric to assess the viability of a REIT investment.

We welcome comments! Please leave us a message in the box below.