Picture from Gov.Sg | PSA Singapore Terminals

Latest estimates from the Ministry of Trade and Industry indicates that Singapore’s economy is forecast to grow by 1-2% in 2016. Against the backdrop of continued slow growth and the gloomy economic climate, we think it is timely to take a step back to evaluate where Singapore is currently, what the economy would look like in the next 20 years and consider what will drive Singapore real estate value in the long run.

Singapore is now a mature economy, lower growth is the new norm

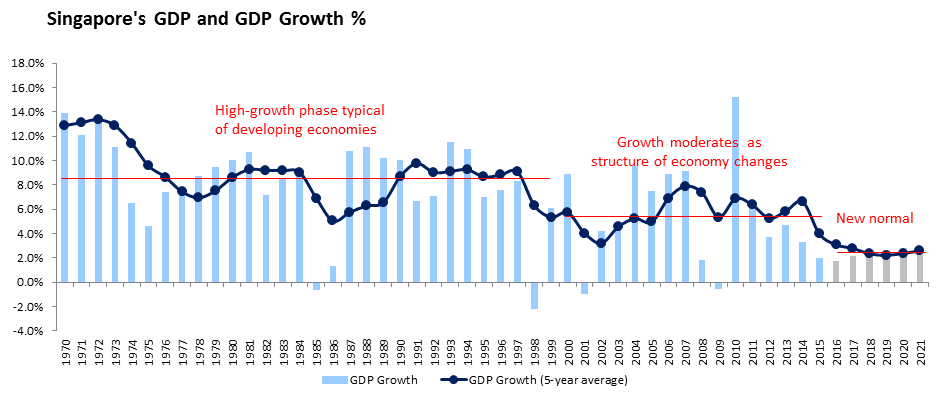

Singapore’s economy has evolved significantly since the country’s independence in 1965. The country has moved from a third world to a first world nation in a short span of over 30 years. From the 70s to the 90s, the country’s GDP had grown at an average pace of 8.2% per annum. However, this has since slowed to an average of 5.5% per annum from 2000 to 2015, reflecting the more mature and developed nature of the economy. Singapore is now on a different growth trajectory with slower growth going forward, in-line with the recent signal to the ruling party by the electorate. IMF had also forecasted that Singapore will grow at an average of 2.4% per annum from 2016 - 2021.

Source: Singstats, IMF

Slow growth is not necessarily bad as lower growth is on the back of a larger base

We need to consider the slower growth in the context of how much economy has grown over the years. Singapore’s economy has more than doubled from 2000 to 2015. The lower growth rate on a larger base means that Singapore is still adding significant absolute value to the economy annually. In the next 5 to 6 years, Singapore will add to the economy the size of a 1984’s Singapore GDP. This is sizeable considering that population growth is concurrently moderating.

Source: Singstats, IMF

Structure of economy is now different and will continue to change going forward

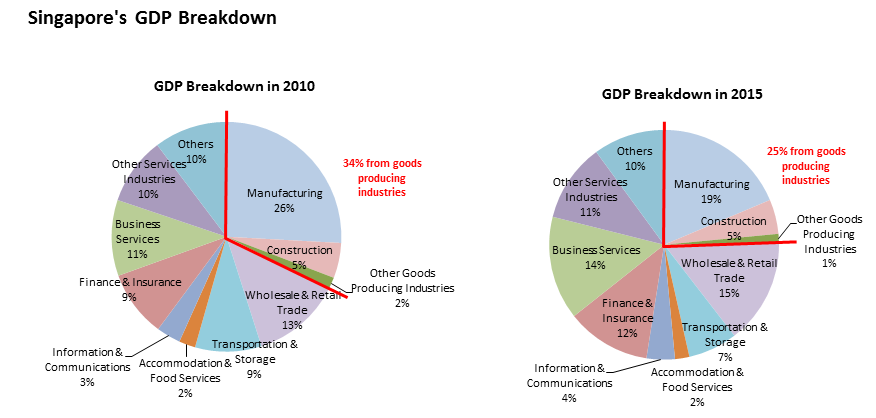

As Singapore continues to restructure its economy, it is important for investors to consider how rapidly the structure of the economy has evolved in the last 15 years. Singapore’s economy is now more diversified and less reliant on manufacturing. Services and tertiary industries now are the main drivers of GDP growth and the trend is expected to continue.

Source: Singstats

From a real estate perspective, this means that traditional end-user demand of real estate is changing as well along with the economy. For e.g., manufacturing will no longer be the main driver for usage of industrial space. Traditional retail trade have now also been ousted in favour of experiential / large format retail experience in malls. Co-working spaces are emerging to change the way office space is being used, etc.

This also means that obsolescence risk for real estate is increasingly real as we see some old economy sectors and industries fade away.

End-user demand will still continue to drive real estate value - important to identify the trends that are emerging

Real estate demand, especially in Singapore, is policy-driven. Hence we believe that real estate investors can take our cue from the economic & regulatory policies that the Singapore Governments will or has implemented to project how the economy will develop.

We see the following key themes playing out in the near future which are driving end-user demand for real estate:

-

Big focus in improving productivity means the industrial sector will see a move towards higher value-add industrial such as advanced engineering, hi-tech manufacturing and R&D. JTC is now more selective towards industrial tenants and usage of industrial space.

-

The support packages announced as part of the Industry Transformation Program in Budget 2016 will see automation and knowledge intensive industry gather traction. SMEs, technology / media companies and start-ups will form new sources of demand for industrial and office spaces.

-

Service industries will continue to be the forward drivers of GDP growth with Singapore seen as the regional APAC / ASEAN hub of tourism, medical services and financial services. This would continue to form the core demand for associated real estate assets.

-

Regional economic policies such as the ASEAN Economic Community and the Trans-Pacific Partnership will be long term drivers underpinning the above mentioned themes.

Closing Remarks

Slower economic growth is the new norm and the search for yield, especially on real assets, has reduce attractive investment opportunities in recent years. However, we believe that investors should focus on where the end-user demand for real estate is to find investment opportunities in Singapore.

In our subsequent posts, we will share sector specific insights and ideas on how investors in Singapore can capture value in real estate investments. We hope the above is helpful for real estate investors to form a high level macroeconomic overview of Singapore. We will love to hear your thoughts and exchange ideas in the comment box below.