With uncertainties around the global economic climate and Singapore’s economic growth, it is a challenge for real estate investors to seek out profitable investment strategies at the moment. We have strong reasons to believe that hotel REITs is a sub-sector to watch out for and could outperform other REIT sectors in the mid-term. In this post, we share our thoughts on the key demand drivers for the travel industry and how hotel REITs will benefit from the trend.

Millennials love to travel and travel spending is a core part of their expenditure

Millennials1 have different spending mindset as compared with previous generations. They are more willing to spend on experiences, e.g. activities such as outdoor dining, art jam sessions, etc. and naturally holiday travels. An article published earlier this year shed some light on the impact of millennials on the travel industry. It was highlighted that millenials currently travel more often for business (4.7 times each year) and leisure (4.2 times per year) as compared to the previous generations. This change in spending behaviour would reshape the travel industry in the years to come.

Proliferation of low cost carriers and cheap energy costs will continue to support travel demand

A key structural change in the aviation industry over the past decade has been the proliferation of low-cost carriers (“LCC”). Coupled with lower energy costs in the last 2 years, the increased in the number of LCCs have supported the growth in international tourism.

Singapore tourist arrivals have recovered strongly in 2016 but this is yet to be reflected in hotel occupancy and room rates

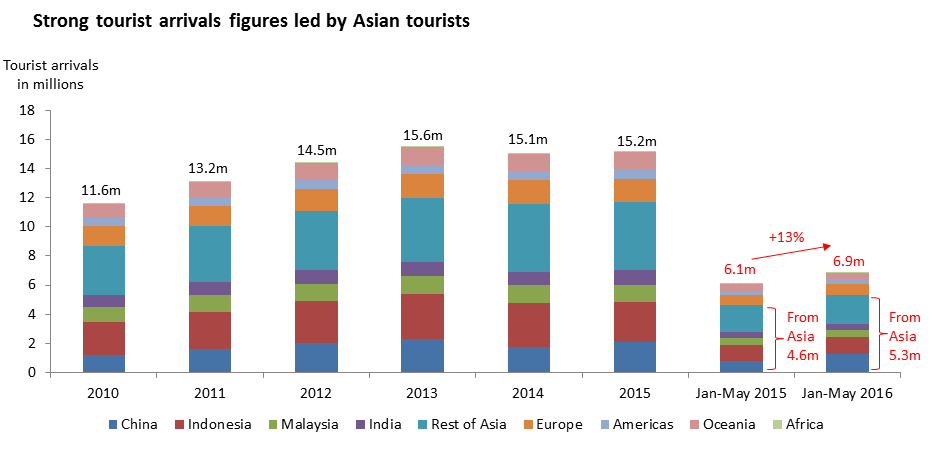

In Singapore, after 2 years of muted growth in tourism numbers (due to aviation disasters and curbs by Chinese authorities on low-cost shopping tours), we see a strong broad-based recovery in international tourist arrivals since the start of 2016. As of May 2016, international visitor arrivals grew 13% year-on-year (y-o-y), led by arrivals from China (+55% y-o-y), Indonesia (+9% y-o-y) and India (+10% y-o-y). Tourist arrivals from other ASEAN countries such as Thailand (+21% y-o-y) and Vietnam (+10% y-o-y) also saw a double digit growth. Singapore continues to be seen as a regional hub for Western tourists visiting Asia, specifically Southeast Asia. Tourist arrivals from Europe, which accounts for 11% of total tourists in Singapore, also saw a double digit growth of 12% y-o-y, notwithstanding fall in European currencies.

Source: Singstats

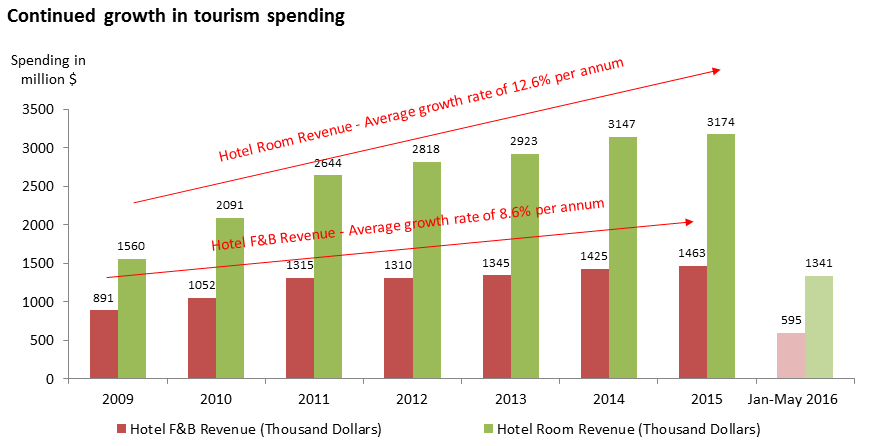

We see the increase in tourism arrivals correspondingly reflected in a increase in tourism spending for the past few years. Hotel room revenues grew 12.6% per annum over the last 7 years while hotel F&B revenue grew 8.6% per annum.

Source: Singstats

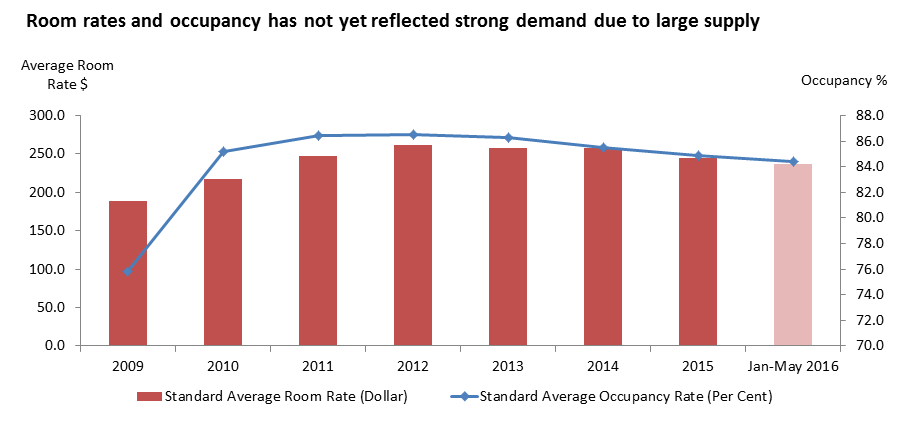

But the strong growth has yet to translate into higher hotel occupancy rates and room rates. This is mainly due to a large increase in supply of hotel rooms in 2016 and 2017.

Source: Singstats

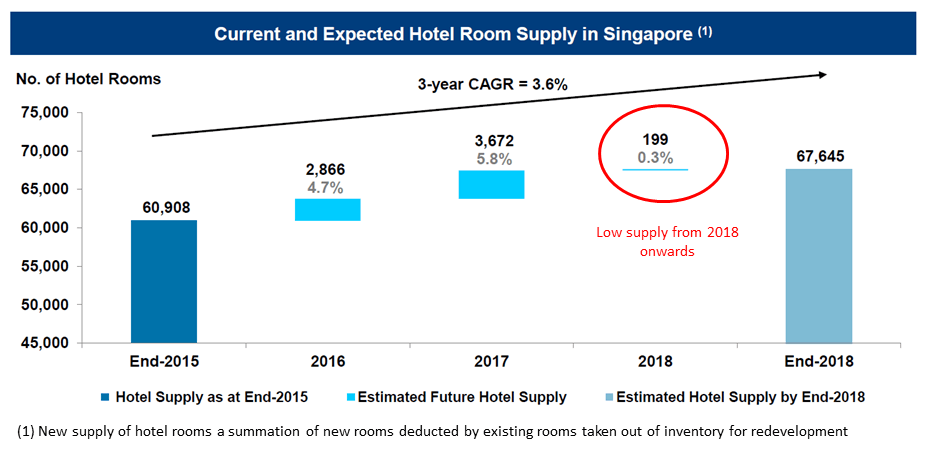

The increase in supply will taper off significantly from 2018 and we believe this would reverse the trend in occupancy and room rate growth within the next 12 to 18 months, assuming travel demand continues to be sustained

Source: CDL Hospitality Trusts

Currency volatility and weak economic sentiments are key risks, but alternative accommodation platforms unlikely to post a threat to hotel demand

The risk to our view is a strong Singapore dollar which will limit tourist spending and “weaker-for-longer” global economic sentiments which results in a decline for business travels. We do not see alternative accomodation platforms (e.g. Airbnb™) as a major threat to Singapore’s hotel demand. These alternative accommodation providers tend to target a different segment of the travellers market, e.g. travellers who prefers a “home-like” experience, travellers on medium-term stays, or family/multi-family large travel groups. Hotels on the other hand offers a higher level of service experience and more amenities. The core traveller demand for hotels would unlikely be materially cannibalized by alternative accommodation providers. It is also worth mentioning that the Singapore Government has been cracking down on short-term rentals of private homes, which continues to be illegal in Singapore.

Impact of the Zika virus in Singapore should not pose a significant threat

We do not think that the spread of the Zika virus is a major threat to the tourism in Singapore. The Singapore government had so far been prompt and responsive in dealing with the cluster cases. Economic impact should be minimal and should not be compared with the outbreak of Severe Acute Respiratory Syndrome (“SARS”) in 2013 as the transmission mode is different and more limited.

Short-term headwinds but strong fundamentals of the travel industry should drive mid-term value of hotel REITs

While there are short-term headwinds, we believe the fundamentals for the hotel market remains strong and outlook is positive. The Singapore Government’s initiative to spur tourism through the SGD 700 million Tourism Development Fund is expected to assist the industry in developing tourism products and improving productivity through technology. These short-term headwinds against Singapore-listed hotel REITs will present a good entry point for investors who are looking to gain exposure to the hotel sector for the long term.

-

Broadly defined as those born from the 1980s onwards. ↩