Singaporeans usually prefers to invest in private residential properties as compared to Real Estate Investment Trust (REITs). We believe this is largely due to

- Emotional security from holding a tangible asset

- Potential for sizable capital gains

- Familarity with the asset class & revenue model (everyone stays in one & renting out a property is simple to understand)

However, the merits of investing in REITs could far outweigh the reasons for investing in residential property (and the risks are arguably easier to manage).

We believe there is a general lack of understanding in REITs investments. For example, people have the notion that REITs have high income yield but low capital gains. However, as REITs (which are essentially “bite-size’ real estate) are traded on the stock exchange, the share price of a REIT is subject to market volatilities and frivolities - moving according to market sentiments, even when the underlying real estate do not change in value on a day-to-day basis. This “mis-pricing” by Mr. Market allows shrewd investors to take advantage of the price movements to make a sizable capital gain on top of income distribution.

Singapore REITs (“S-REIT”) are the one of the best yielding in the world as compared with other established REIT markets such as the US, UK, Japan and Australia. Potential investors who likes exposure to the real estate sector can look at S-REITs as a viable alternative to private residential property. REITs allow retail investor who do not have a huge capital base to start investing via small capital outlays and build up a portfolio of good yielding REITs over time. As an exchange traded instrument, it is also more liquid, allowing investors to invest and divest much more easily compared to holding onto an actual brick and mortar property. There is also no need to consider the impact of Additional Stamp Duties.

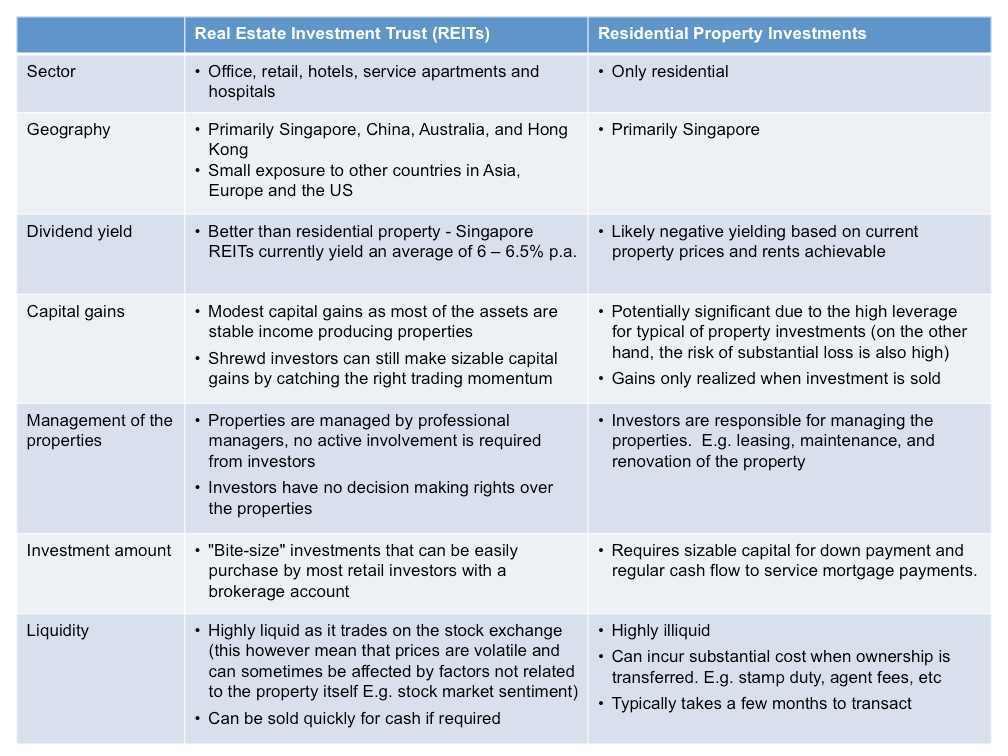

In the table below, we compare the differences between investing in REITs with investing in private residential property.

We are interested in your thoughts about building up a strong dividend yielding REIT portfolio. Leave your comments below to discuss!