Picture By Erwin Soo

In 3Q 2016, Singapore’s private residential property prices continue to slide by 1.5%, taking the total drop in property prices to 11% from its peak in 2013. Market watchers and potential investors continue to wait for the elusive bottom in this property cycle. We believe that there is room for further decline in property prices and we share the key reasons behind our view.

1. Demand for residential units is weak and likely to continue

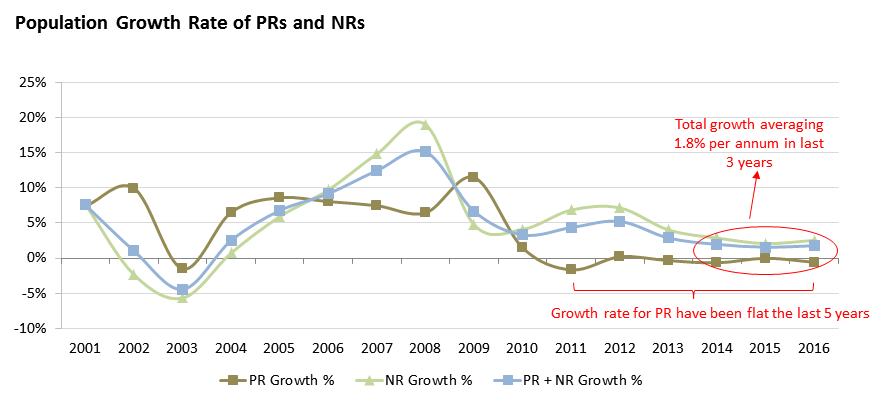

Both leasing and buying demand for private residential units are highly correlated to the growth in the population of permanent residents (“PR”) and non-residents (“NR”, e.g. work permit holders, foreign students, etc.). Since the tightening of immigration and foreign labour policies in 2011, the growth in the number of PRs and NRs have remain low at an average of c.1.8% in the past 3 years and are rather flattish if we take a 5 year view.

Source: Singstats

This low growth rate has resulted in a weak rental market (demand) for residential units, the latter which is one of the leading indicators of property prices. With the rental index dropping 5.9% since the beginning of 2015 and 1.2% in 3Q 2016 alone, we see no indications that the decline is slowing. It is currently a tenant’s market and rents are likely to decline further for the remaining of 2016 and 2017 with the impending rates hike in December.

2. Significant number of completions in the last 3 years has resulted in the doubling of vacancies. Absorption of supply will take time

From a low of approximately 5% vacancy in early 2011, vacancies has since risen to (and is now hovering at) c.9% based on the latest data from URA.

Source: Singstats

There remains substantial completions in 2017 and 2018, albeit at a slower pace than 2016. Over 31,000 units will be completed between 2017 and 2018 with the market likely to take sometime to absorb these supply due to the demographic trend outlined above. We therefore expect vacancies to further increase in the short term, possibly reaching low teens in vacancies percentages as these completed units enter the market over the next 24 months.

Source: Singstats

3. Policy remains restrictive and removal of cooling measures not expected in the near future

The benign job market is a concern for the goverment and we note that PMETs, who are the most likely renters, had been especially hard hit in the recent layoffs, accounting for 71% of the redunancies. Household debt among Singaporeans is near the peak and the largest proportion of household debt is from property mortgages. The goverment will likely to continue focusing on affordability as a priority and hence we do not expect the government to implement any policy that would have the potential of increasing property prices in the near term.

Our View

We continue to believe that the weak demand and the large supply coming onboard for the remaining of 2016 to 2018 will continue to weigh down residential property prices in Singapore in the next 18 months. There remains likely another 5-10% decline before a bottom is reached, although we caveat that a 5% downside is more likely than 10% in the short to medium term. Properties in Core Central Region should hold up relatively better as compared to Rest of Central Region and Outside Central Region. Investors should remain cautious and conduct proper due diligence when considering making an investment in residential property now. There is a lot of investor interest to hold cash instead for now.

We love to hear your thoughts. Do leave us a message in the box below.