Most blue-chip Singapore REITs(S-REITs) prices have declined 4% to 6% on average since the results of the US Presidential Elections. S-REITs now trade at an average of 6.8% yield and 0.95x Price to NAV (P/NAV) as of 24 November 2016. With the weakness in S-REIT prices in the last 2 weeks, is now a good time to invest into the sector?

The weakness in S-REITs reflects the risks of an impending Feds rate hike in December 2016 and the uncertainty in global economic growth with the Trump presidency. However, we think that most of the risks have been priced in and the recent weakness in share prices presents an opportunity for investors to accumuate S-REITs at a reasonable prices. In this post, we share the reasons behind our view and a simple way to look at S-REIT valuation in general.

Expect interest rates to move up, but any increases should be moderate

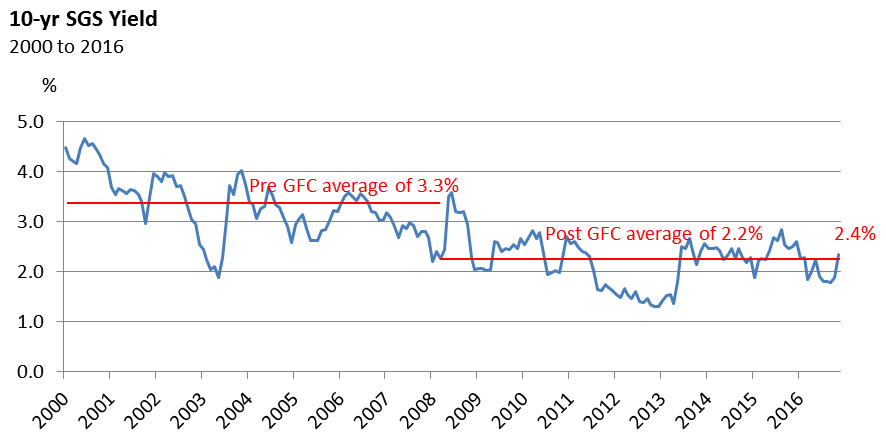

One of the key drivers of profitability for REITs is interest costs, and hence, we need to consider the implications of the long term risk-free rate on REITs. The 10-year Singapore Government Securities(SGS) yield (also called the SG risk-free rate) is a key benchmark for S-REIT valuations. This benchmark rate has moved up approximately 50 percentage points since the results of the US Presidential Elections reflecting the scenario of a likely interest rate hike in December 2016. This have resulted in the correction of S-REIT prices in the last two weeks.

While the market consensus is for long term government bond yields to rise, most also expects the increase to be modest. For the eight-year period from 2000 to 2007 (pre GFC), the 10-yr SGS yielded an average of 3.3% per annum. However, in the last 8 years (post GFC), the yield was an average of 2.2% per annnum. We believe that the uncertain global political risk, aging demographics, less aggressive immigration policies, high debt burdens, lower inflation, and the lower growth outlook should support the view of a structurally low risk-free rate. We therefore expect the 10-yr SGS yield to be stay between 2% to 3% in the next decade.

With the 10-yr SGS yield currently at 2.4%, there is still room for further increase, but we expect the increase to be moderate and over a long period of time. Therefore, we believe that any negative impact to the financial performance of S-REITs should be minimal as S-REITs are pretty lowly leveraged (comparing with private real estate funds and residential investments) and most of their interest costs are hedged mid-term.

Value is emerging in S-REITs and downside risks seems priced in

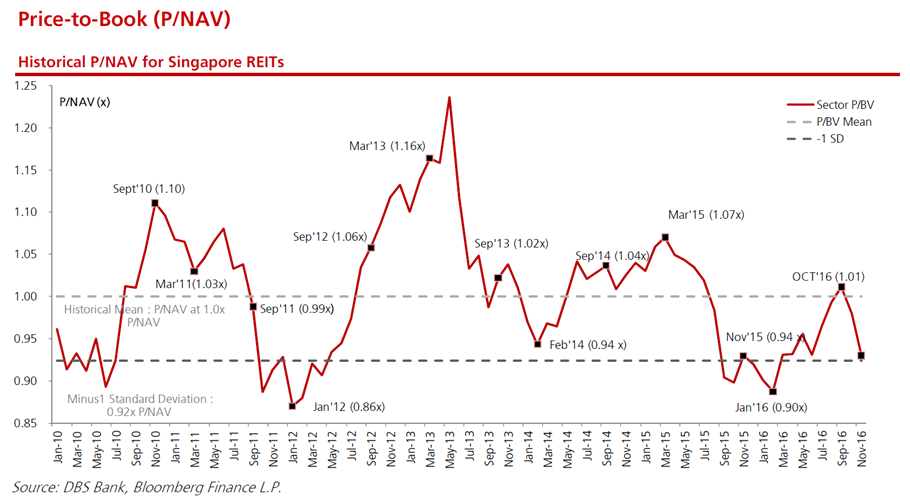

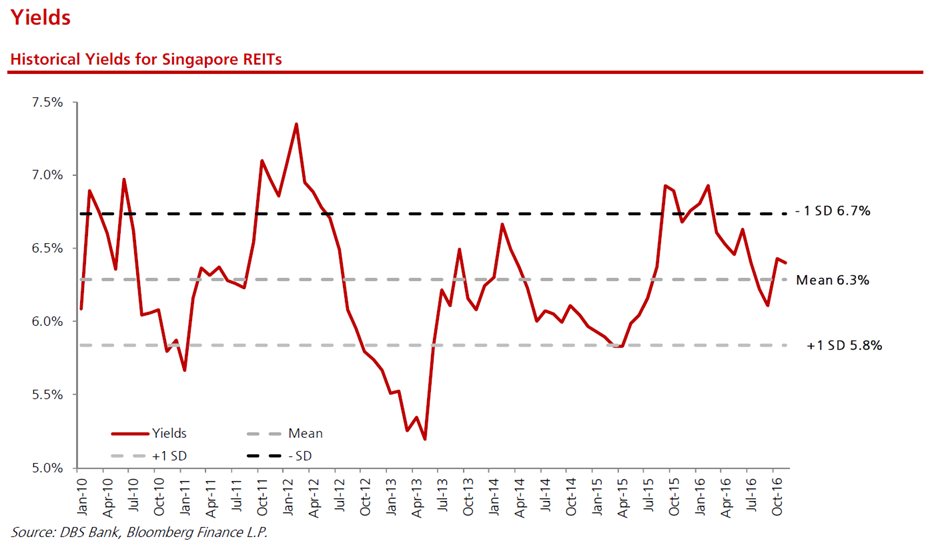

Historically, S-REITs trade at an average of 1.0x Price-to-NAV(P/NAV) and 6.2% yield. At current P/NAV of 0.95x, S-REITs are trading at close to their -1 Standard Deviation(SD) of 0.92x P/NAV.

In addition, the current S-REIT yield of 6.8% is also above the +1 SD of 6.7%.

A more important metric however is the S-REIT yield spread. The S-REIT yield spread is the difference between the average S-REIT yield and the 10-yr SGS yield. This is argubably a more important metric than yield because this implies the premium investors wants to be compensated for relative to the risk-free-rate.

Currently, the yield spread is at 4.4% (S-REIT yield of 6.8% minus the 10-yr SGS yield of 2.4%). Historically, the mean S-REIT yield spread has been around 4.2%.

The above metrics suggests that S-REIT is trading at slightly below fair value, and barring any unforeseen major financial catastrophe, the downside risks of S-REIT seems to have been priced in.

Long term valuation of the S-REIT sector looks fair

Here is another simple way to look at the long term valuation of S-REITs.

If we expect the long term risk-free rate (10-yr SGS yield) to be between 2% to 3% on average, then based on the historical S-REIT yield spread of 4.2%, REITs should trade at around 6.2% to 7.2% yield on a fairly valued long term basis.

Based on the current trading yield of 6.8%, we can imply that S-REITs are trading within the fair value range (and slightly above the mid-point). Therefore, we believe that any (further) price weakness presents a good opportunity to accumulate into the sector.

Final words

While we have only presented a high level view of the S-REIT sector valuation, investors are still recommended to do their homework and analyze each REIT from a bottom up perspective.

Many property sectors in Singapore are undergoing structural changes. For example, the retail scene has evolved significantly from traditional shopping malls to now large format experential retail or online shopping; Conventional large floor plates office spaces for financial instituition are now giving way to hot-desking or co-working spaces for FinTech companies and startups. The way in which real estate spaces are being used is being redefined in this generation.

Investors need to go back to the fundamentals of real estate - understand how end users of real estate will drive demand for different classes of real estate - to identify pockets of opportunity for investments.

We love to hear your thoughts. Please leave us a comment below.